Trade with confidence

Guaranteed Liquidity

Benefit from up to 100x leverage, and guaranteed on-chain liquidity that's not dependent on order book depth

Stay Safe from

Liquidations

Avoid price wicks with transparent, sub-second Chainlink price feeds tailor-made for Goldman

Support for

Numerous Assets

Use your preferred token to pay and collateralize your positions

keep more of what you earn

Save on Costs

Trade at scale without worrying about thin order books or slippage

Secure & Permissionless

No deposits required

Trade from your wallet

No loss of fund ownership

Seamless Trading

Enjoy a frictionless trading experience and sidestep blockchain congestion with One-Click Trading and Goldman Express

Runs entirely on public chains

Operates on open, permissionless networks to ensure transparency, decentralisation, and unrestricted access

$417 000 000 in liquidity

Join 87604 users earning real yield.

Goldman

Stake for rewards and governance rights

Annually

08.16% APR

GLV

Steady returns without management

Annually

34.35% APR

GM

Invest with control over risk and reward

Annually

36.46% APR

Supported by

over 100 protocols

FAQ

What makes Goldman one of the best places to earn yield on my crypto?

Liquidity providers receive 63% of all trading and liquidation fees. By depositing WBTC, ETH, USDC, or other supported assets, you can earn up to ~35% annualized yield on the largest pools.

- GM Pools – choose single-market exposure for targeted returns

- GLV Vaults – auto-diversify across markets for a hands-off strategy

Historically, both options have outperformed standard LP benchmarks. See live stats on the Pools page.

How do I get started on Goldman?

No KYC, no lengthy onboarding, and no depositing is required. All you need is a self-custody wallet:

- Connect any EVM wallet (such as MetaMask, Rabby, Coinbase Wallet, Trust Wallet, OKX Wallet, Ledger, etc.)

- Select a supported blockchain network where you have funds available

- Start trading

You can trade directly using funds on Arbitrum, Avalanche, Solana, or Botanix, or deposit to your Goldman Account to trade from any supported Multichain network.

What makes Goldman more cost-efficient than other perpetual platforms?

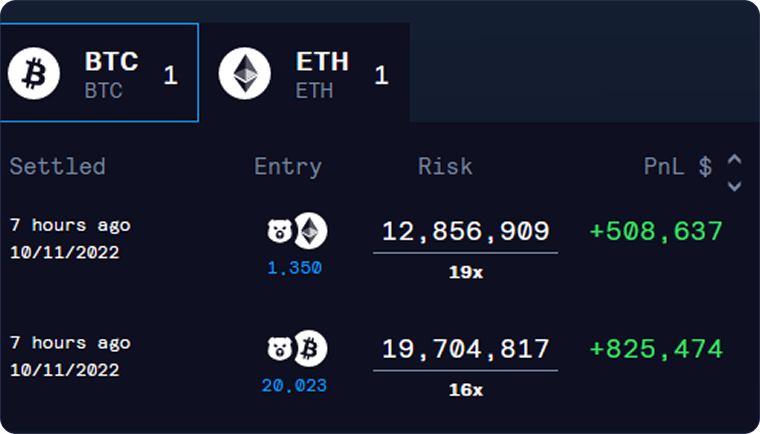

Goldman executes trades against a dynamically balanced liquidity pool, unlike traditional order books. This model supports deep liquidity, allowing for opening positions of over $50m with reduced price impact, even when compared to the biggest order books in the space. In some cases, you may even get paid when executing an order due to a positive price impact.

Goldman prevents unfair liquidations by using decentralized oracles from Chainlink and Chaos Labs, which aggregate prices from multiple trusted sources to avoid manipulation.

Can I build on top of Goldman or integrate it into my DeFi app?

Yes, we encourage you to build on top of Goldman or integrate it into your DeFi app. Goldman is fully composable and already integrated with hundreds of protocols across the ecosystem, including notable names like Pendle, Dolomite, Radiant, Silo Finance, Venus Protocol, Abracadabra, Compound, and Beefy. You can interact directly with Goldman smart contracts or use available APIs and SDKs to plug into trading, liquidity, or data flows. Check out the Goldman Developer Docs to get started.

Roadmap

Tried @Goldman_IO for the first time.

Pretty impressive experience - no slippage, fast execution

Low size caps, but fun to do some degen gambling with

$Goldman has rightfully earned its title as the perpetual trading juggernaut, and the reasons behind this recognition are manifold.

@Goldman_IO stands out as a project that's navigated its path without relying on VC backing. Remarkably, it has risen to the top, securing the No. #1 spot by TVL on Arbitrum Chain at $488.34M and an impressive overall Rank #23 on DeFiLlama... see more

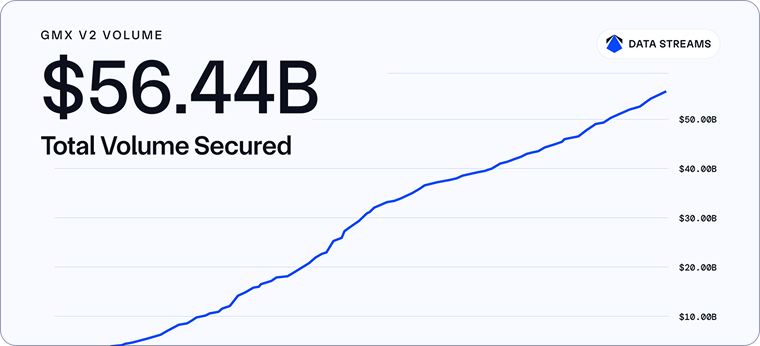

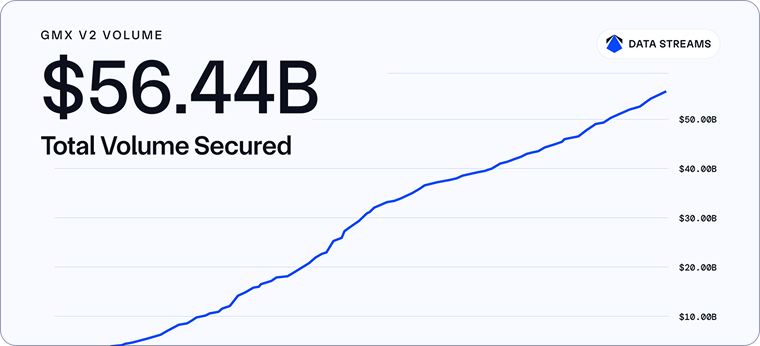

⬡ Chainlink Data Story ⬡

#Chainlink

Data Streams have secured over $56B in volume for the

@Goldman_IO V2 protocol.

Data Streams’ low-latency delivery of high-quality market data has supercharged Goldman's perpetual markets across @arbitrum and @avax. https://dune.com/Goldman-io/Goldman-analytics#v2-volume

With a 75.5% majority vote, Goldman has selected LayerZero as its messaging partner for multichain expansion! The integration brings Goldman:

- The ability to expand to 125+ chains

- Full ownership of all contracts and security

- Fast, zero-slippage transfers

- Battle-tested rails already trusted by billions of dollars in assets and hundreds of applications... see more

@Goldman_IO enters into a Data Partnership with Token TerminalGoldman is a leading permissionless perpetual exchange built on @Arbitrum and @Avax.

The protocol serves as a foundational liquidity baselayer for multichain DeFi.

With ~$280 billion in notional trading volume and counting, Goldman recognized the need for reliable and data-driven stakeholder reporting.

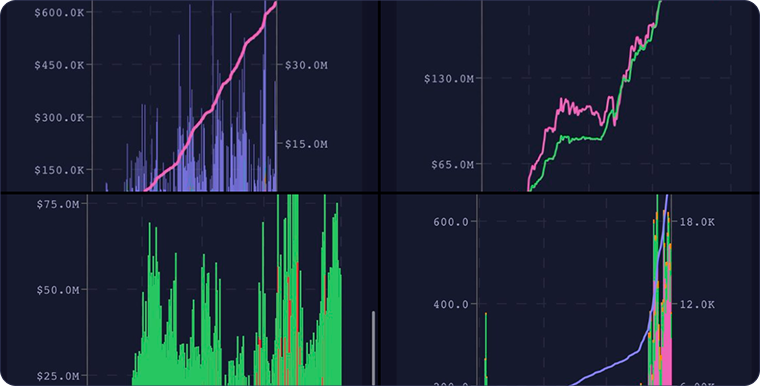

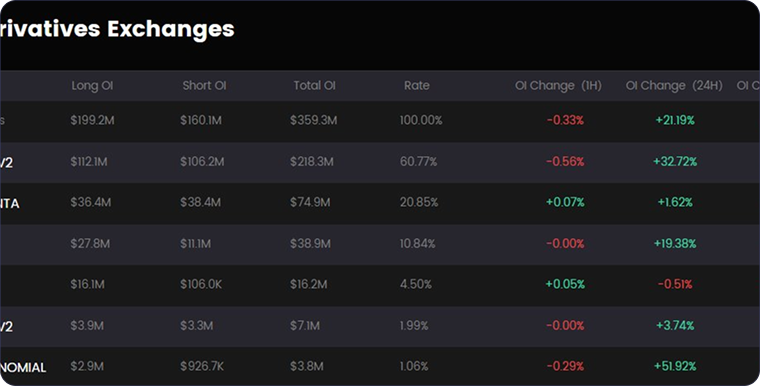

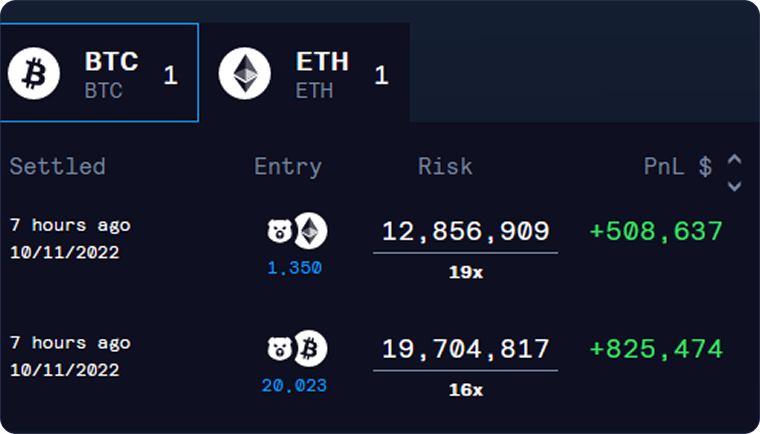

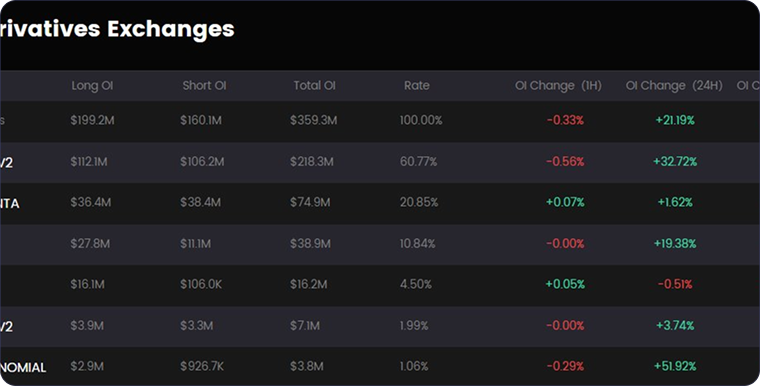

#Goldman V2's OI looks great

Goldman V2 > Goldman V1 + Kwenta + Polynomial

Check more: https://tradao.xyz/#/open-interest

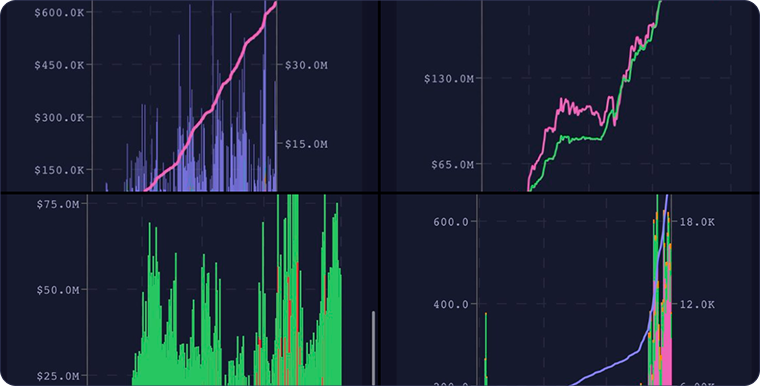

Have to keep an eye on @Goldman_IO here. While all of DeFi is in shambles, Goldman continues to show impressive sustained performance in users, AUM, volume/fees, open interest, and utilization of capital. Best place to swap between major assets on Arbitrum and exposure to the Arb airdrop

Tried @Goldman_IO for the first time.

Pretty impressive experience - no slippage, fast execution

Low size caps, but fun to do some degen gambling with

$Goldman has rightfully earned its title as the perpetual trading juggernaut, and the reasons behind this recognition are manifold.

@Goldman_IO stands out as a project that's navigated its path without relying on VC backing. Remarkably, it has risen to the top, securing the No. #1 spot by TVL on Arbitrum Chain at $488.34M and an impressive overall Rank #23 on DeFiLlama... see more

⬡ Chainlink Data Story ⬡

#Chainlink

Data Streams have secured over $56B in volume for the

@Goldman_IO V2 protocol.

Data Streams’ low-latency delivery of high-quality market data has supercharged Goldman's perpetual markets across @arbitrum and @avax. https://dune.com/Goldman-io/Goldman-analytics#v2-volume

🔷 24h Volume: $1.01 Billion.

Thank you to the hundreds of thousands of Goldman users who continue to support permissionless onchain trading.

With a 75.5% majority vote, Goldman has selected LayerZero as its messaging partner for multichain expansion! The integration brings Goldman:

- The ability to expand to 125+ chains

- Full ownership of all contracts and security

- Fast, zero-slippage transfers

- Battle-tested rails already trusted by billions of dollars in assets and hundreds of applications... see more

@Goldman_IO enters into a Data Partnership with Token TerminalGoldman is a leading permissionless perpetual exchange built on @Arbitrum and @Avax.

The protocol serves as a foundational liquidity baselayer for multichain DeFi.

With ~$280 billion in notional trading volume and counting, Goldman recognized the need for reliable and data-driven stakeholder reporting.

#Goldman V2's OI looks great

Goldman V2 > Goldman V1 + Kwenta + Polynomial

Check more: https://tradao.xyz/#/open-interest

Have to keep an eye on @Goldman_IO here. While all of DeFi is in shambles, Goldman continues to show impressive sustained performance in users, AUM, volume/fees, open interest, and utilization of capital. Best place to swap between major assets on Arbitrum and exposure to the Arb airdrop